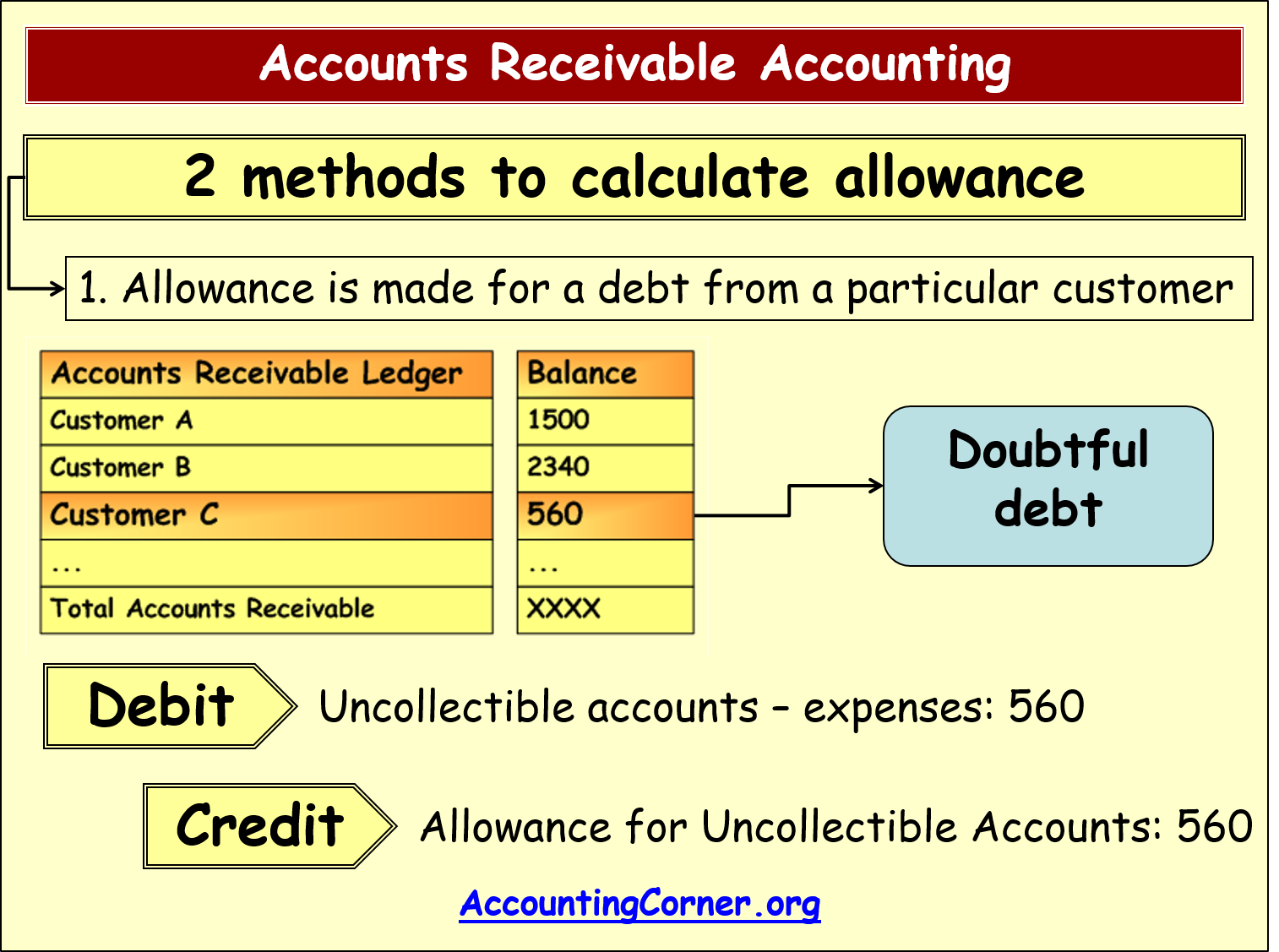

Sales Returns and Allowances is a contra-revenue account deducted from Sales. It is a sales adjustments account that represents merchandise returns from customers, and deductions to the original selling price when the customer accepts defective products. Credit memos serve as vouchers for entries in the sales returns and allowances journal.

Classification and Presentation of Sales Returns and Allowances

By examining historical data, businesses can identify patterns and recurring issues that may be prompting allowances. For instance, a spike in allowances related to product defects could indicate a quality control problem that needs addressing. Similarly, frequent allowances due to shipping delays might suggest logistical inefficiencies that require optimization. A contra sales revenue account–such as journal entry for rent received with examples, Returns and Discounts-has a debit balance because it is contrary to the credit balance of a regular Sales Revenue account. Revenues define the income from a company’s operations during an accounting period. Regardless of their source, revenues play a significant role in a company’s profits and success.

Format of Sales Returns and Allowances Journal

However, they encounter some problems after the purchase, or it becomes defective shortly. However, the seller gives them a specific allowance on the selling price of the faulty product. The buyer accepts the offer of the seller’s allowance and keeps the product with them.

Do you own a business?

- By examining historical data, businesses can identify patterns and recurring issues that may be prompting allowances.

- If the return or allowance involves a refund of the customer’s payment, “Cash” is credited.

- As such, it debits a sales returns and allowances account (or the sales revenue account directly) and credits an asset account, typically cash or accounts receivable.

- Adhering to this principle helps prevent discrepancies in financial reporting and provides a more accurate picture of the company’s financial performance.

- During this process, the goods may go under physical changes or deformities.

For instance, if a customer receives a damaged product, the company must assess the extent of the damage and its impact on the product’s usability. This assessment often involves collaboration between customer service, quality control, and financial departments to ensure a fair and consistent allowance amount. The goal is to offer a partial refund or discount that compensates the customer adequately without unduly impacting the company’s profitability.

Upon receiving the machine and realizing how outrageously impractical their impulse buy was, they sent it back. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Finance Strategists has an advertising relationship with some of the companies included on this website.

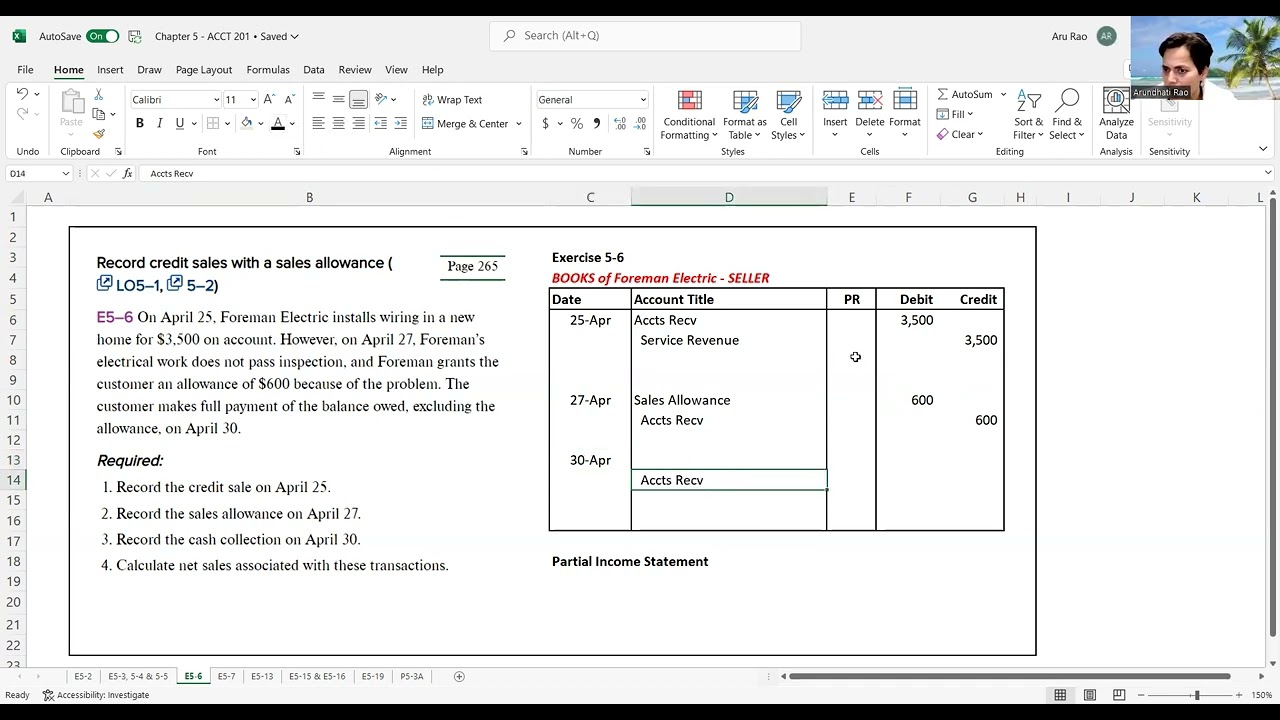

Accounting 101: Accounting Basics for Beginners to Learn

If a cash refund is made due to a sales return or allowance, the sales returns and allowances account is debited and the cash account is credited. The original billing was for $10,000, and the company convinces its customer to pay for the out-of-spec goods with a sales allowance of $1,000. The journal entry recorded by the company for the sales allowance is a debit of $1,000 to the sales allowance account and a credit to the accounts receivable account of $1,000. When the customer pays the $9,000 bill, this eliminates the customer’s payment obligation. Sales allowances are a critical aspect of accounting that can significantly influence a company’s financial health.

Employee training is a critical component of effective sales allowance policies. Staff members, particularly those in customer service and sales roles, should be well-versed in the company’s policies and procedures. Regular training sessions and updates can help ensure that employees are equipped to handle allowance requests efficiently and fairly.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Therefore, companies strive to increase the numbers as high as possible. The company, in the interest of its commitment to customer service, offers a $20 partial refund. The company sends them the money, and its accountant debits $20 to its sales and allowances while crediting $20 to its accounts receivable.

To indicate that dual posting is necessary, a diagonal line is drawn in the P.R. At the end of the period, ABC Co.’s net sales on its financial statements were as follows. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.