For companies in the business of lending money, Interest Revenues are reported in the operating section of the multiple-step income statement. These GAAP differences, combined with the various accounting judgments that often affect the recognition of revenue, mean that revenue and performance from customer contracts may be reported differently across peer companies. Dual preparers and users of financial statements should carefully assess the effect of key differences between IFRS Standards and US GAAP in this area. Businesses record their financial transactions in the books of accounts on the basis o the generally accepted accounting principles (GAAP). A company following GAAP would record both interest revenue and interest receivables in the designated sections of the income statement.

About the IFRS Foundation

For instance, if a bank lends £10,000 to a small business, the principal amount in this case would be £10,000. Interest Revenue can be defined as the earnings generated by a company from its lending or investing activities. Use the RFP submission form to detail the services KPMG can help assist you with. The amendments in the ASU are effective for fiscal years beginning after December 15, 2022 for public business entities and December 15, 2023 for all other entities. Sales of a subsidiary or equity method investee are outside the scope of IFRS 15 and in scope of the deconsolidation guidance (IFRS 10 and IAS 28, respectively). KPMG has market-leading alliances with many of the world’s leading software and services vendors.

Steps on How to Calculate Interest Revenue

US GAAP has no general guidance for recognizing a provision for onerous contracts, but instead the specific recognition and measurement requirements of the relevant Codification Topics/ Subtopics apply. Most companies earn interest income; however, not all of these companies treat interest income as their primary source of income. Therefore, a bank would record interest revenue in the revenue section at the top of the income statement. This interest income earned by the company in the given time period is called interest revenue for the company. Suppose ABC Ltd. is an automobile company with a substantial cash surplus. The company has invested $100,000 in an interest-bearing financial asset, for, say, a certificate of deposits that pays an annual interest rate of 5%.

Contact KPMG

Note that in this calculation we expressed the time period as a fraction of a 360-day year because the interest rate is an annual rate and the note life was days. If the note life was months, we would divide by 12 months for a year. Sometimes a lender or textbook uses this “bank method”—so called because some banks would use 360 days instead of 365 since that actually results in a higher effective interest rate. The main issue with interest revenue is where to record it on the income statement.

By the end of the first year, Company A has earned interest revenue of $30,000 (6% of $500,000). Even if Company B hasn’t yet paid this interest, under the accrual basis of accounting, Company A can recognize the $30,000 as interest revenue for that year. On the income statement, it would be recorded under revenue, often as a line item called “Interest Revenue” how to keep accounting records for a small restaurant chron com or “Interest Income. Interest revenue, also known as interest income, is the revenue earned by a company or individual from lending money or holding interest-bearing assets. It represents the compensation received for the use of money over a period of time and is a crucial component in the analysis of a company’s financial performance and profitability.

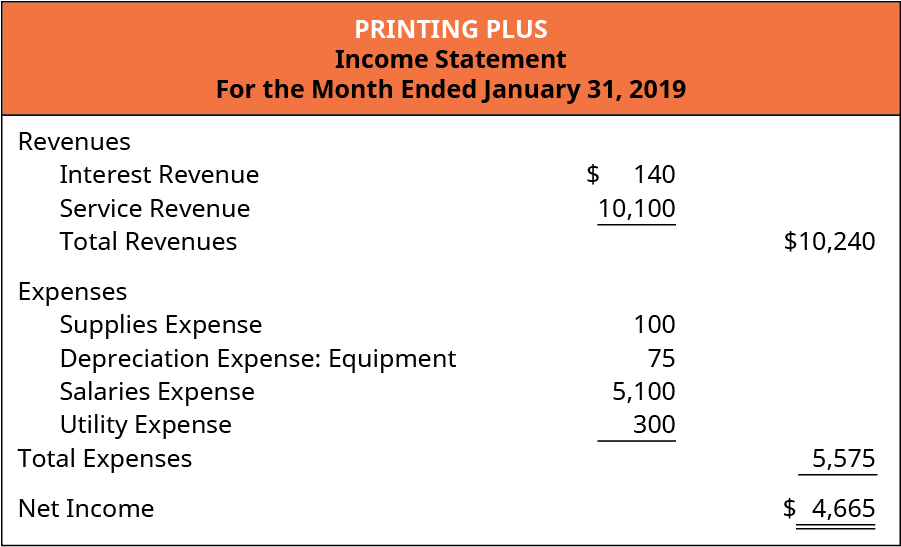

Financial Accounting

At the same time, it is to record the interest income that the company has earned during the current accounting period. The journal entry at the end of the period is necessary for the company to recognize the revenue that it has already earned. Likewise, the total income and assets will be understated in the financial statements if no necessary adjusting entry is made for the interest income. Under the accrual basis of accounting, the Interest Revenues account reports the interest earned by a company during the time period indicated in the heading of the income statement. Interest Revenues account includes interest earned whether or not the interest was received or billed. Interest Revenues are nonoperating revenues or income for companies not in the business of lending money.

To account for receivable and income, you’ll need nothing more than a good calendar and a basic calculator. Let’s work through a simple example of how to calculate and account for interest receivable and interest revenue for notes receivable. The 360-day-year convention is not used very often anymore since computers have made it easier for banks and companies to calculate interest using actual days (365 or 366, depending on the year). Also, in calculating the due date of a note, start on the day after the date on the note (don’t include that day, but do include the last day).

- We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations.

- The IASB is supported by technical staff and a range of advisory bodies.

- Vaia is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels.

- If an entity disposes of property, plant and equipment at the end of its useful economic life the proceeds of disposal are not revenue for the entity.

- This journal entry is to recognize the $150 of interest income that the company has earned from its fixed deposit with XYZ Bank in the month of June 2020.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Everything you need to know to calculate an interest rate with the present value formula.

Many companies have interest-bearing assets, such as loans and investments, that generate a stream of income for the company. That interest can be categorized as either “interest receivable” or “interest revenue.” These accounting terms have slightly different meanings. This example illustrates how interest revenue is earned, recognized, and eventually collected.

Both interest revenue and interest expense are recorded in the income statement. Interest revenue is the interest that an entity earns from the money it has lent or the investments it has made. Suppose Company A lends $500,000 to Company B at an annual interest rate of 6%. The terms of the loan dictate that Company B will repay the interest annually. Vaia is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations.